Three Tips For Starting a Budget in the New Year

Articles may contain affiliate links.

Hey you! I’m super excited to have Jasmine of Simply By Heart here to talk about budgets! I know that budgets aren’t as exciting as fun new journaling supplies, but don’t click away. Wrangling your budget and getting it under control is one of the best ways to work toward your overall goals, save money and take care of yourself. There is no better comfort than knowing that your finances are under control. Jasmine is here to provide us with three of her favorite tips for starting a budget in the new year and rocking your money goals. I’ll let Jasmine take it from here! -Shelby

Three Tips For Starting a Budget in the New Year

The holiday season can be pretty brutal to anyone’s wallet. A lot of money is spent on traveling, gift-giving, entertainment, dining in, and dining out. If you’re looking to begin budgeting or even continue your budget for the new year – here are three tips for starting a budget in the new year!

#1 – See Where Your Money is Going

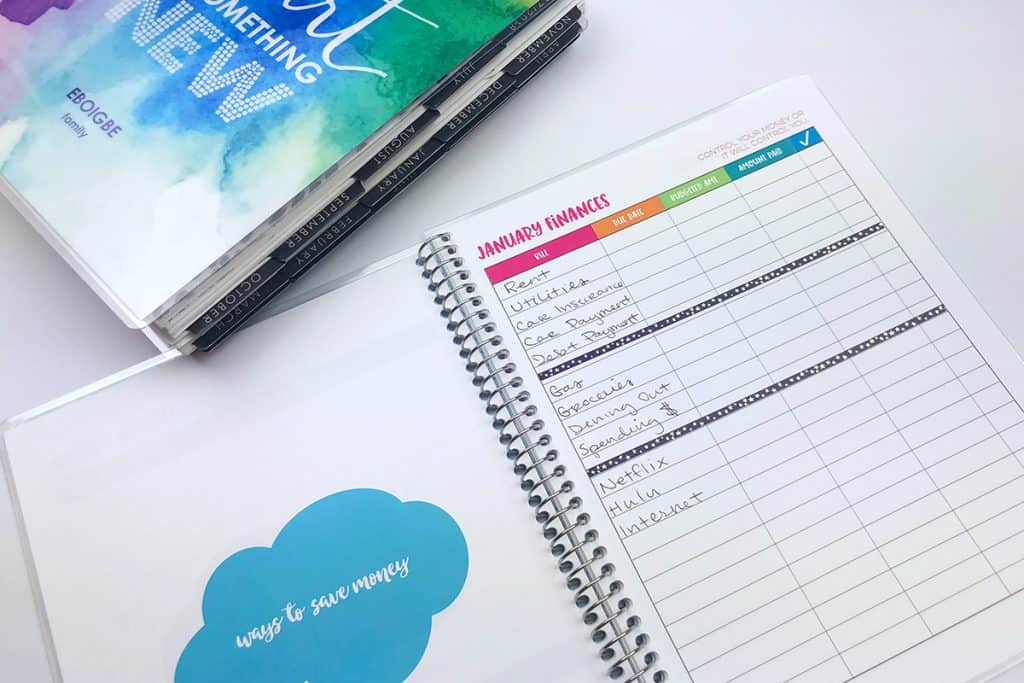

Take time to write out everything you spend money on. Every. Little. Thing. Bills, groceries, insurance, car care and maintenance, dining out, gift giving, online purchases, subscriptions, quick stops at the store, health and wellness related expenses… everything. You do this at the start and end of each month to have an idea of how much of your income is going to pay for things and how much will be going into savings. I keep track of these things in a notebook. Writing them out in the same place each month allows me to see any spending trends and keep track of things that are only due annually.

Writing it out is helpful because it gives us an idea of where those nickels and dimes are ending up. Our family follows a zero-based budget. Instead of having ‘extra money’ in our bank account at the end of each month, we plan for all of our income to be spent or saved in different categories. This helps keep us in the mindset of paying off and saving. When we had money that isn’t destined for spending or savings, we made more unnecessary purchases. Seeing where your money is going, may help motivate you to start that side hustle you’ve always wanted to start. A side hustle like starting a blog can be a great way to earn a little extra income to help pay down debt.

#2 – Set Money Goals and Write Them Down

One of my favorite Dave Ramsey quotes: A budget is telling your money where to go, instead of wondering where it went.

At the start of each year (or quarter), it’s important to know what big and little things you will need to spend money on. We set goals for vacations, family activities, other costs and savings at the start of each year. We also review our progress each month. I like to keep track of this in my budget planner. Having a planner just for budgeting helps me to see the progress we are making and it helps keep it front of mind when deciding to make big purchases.

Our family budget planner helps keep track of due dates, amounts due, extra expenses, and anything that relates to money. If my husband or I need to know when our annual payments are due, we can easily refer to the planner. For the New Year, I am incorporating a more visual tracking system for our vacation savings. Hello, Disney, here we come!

#3 – Make Budgeting a Habit

My husband and I meet once a month to talk about our household budget. I like to see where our money is going, by writing things down in my planner. He likes to know that things are taken care of and we’re making progress with paying off our debts (ugh, student loans) (ugh, credit). We set a date in the family planner and get together in the evening. Then we review the current month and make sure things are set for the upcoming month. In order to be successful in budgeting, whether a personal budget or shared, it has to become one of those things you must do.

We know that reaching our debt repayment and savings goals are important for us as a family, so we prioritize these meetings. I bring the budget planner, a pen, and a calculator. My husband is in charge of looking up due dates and amounts due on his phone or laptop. I’m excited to start involving our kids in future meetings when they start their own savings. We want to teach them the importance of money management and earning things through hard work.

Hit Your Goals this Year

If budgeting becomes the thing you do regularly, you will have no problem keeping your money goals. And keeping your money goals means that you can accomplish your other goals with more comfort and peace of mind. Basically, starting a budget in the new year is one of the best goals you can set for yourself. So what are you waiting for?

Are you just starting a budget in the new year or continuing to budget? What is your favorite budgeting technique?

I MY NAME IS MS, LYNETTE A,A MILLER AND I WAS JUST WONDING IF I CAN BUY FROM YOU A PLANNER I DON,T HAVE A PRINTER PLEASE LET ME KNOW HOW MUCH THE PLANNER ARE AND I,LL WILL SEND YOU A CHECK FOR IT OK. THANK YOU FOR YOUR TIME MS, LYNETTE A, MILLER

I’m so sorry Lynette but I don’t currently sell planners. You can purchase blank ones at many stores as well as some that are pre-printed. Let me know if you have any further questions and I would be happy to guide you.